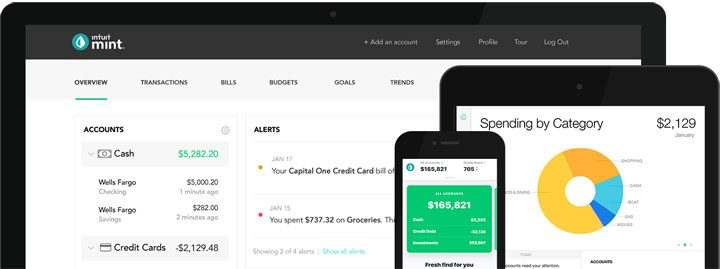

The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. The cookie is used to store the user consent for the cookies in the category "Performance". We understand that you might want to track your spending habits through budgeting apps, like Frollo and thats okay. The financial planning app makes it easy to monitor progress in achieving your financial goals and control expenses. Mint provides budgeting tips & advice to help you save for your financial. Get a smart expense budget based on your spending on day 1.

#Budget planning app qu free

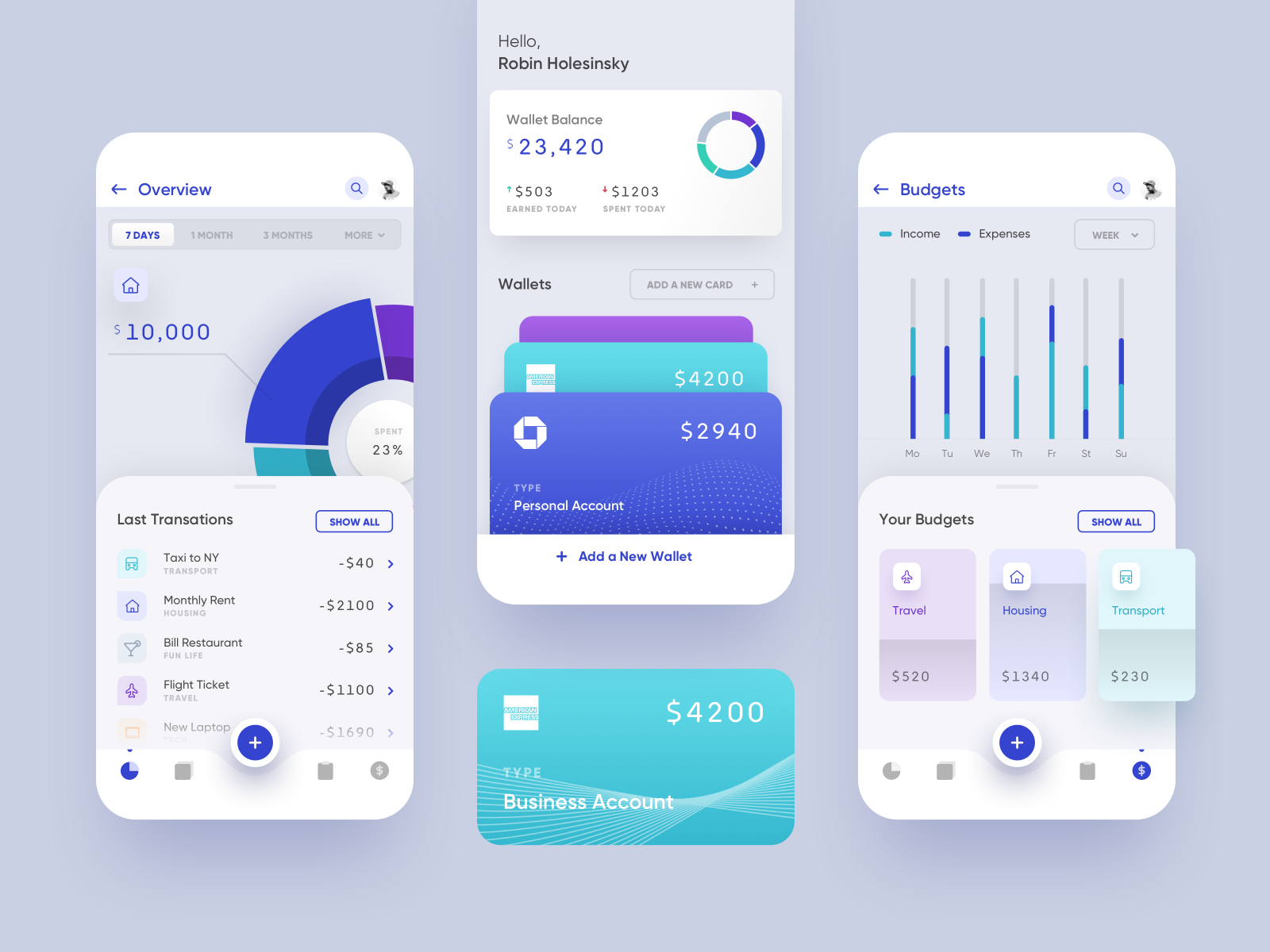

This cookie is set by GDPR Cookie Consent plugin. Make every dollar count with our free budget app. The cookie is used to store the user consent for the cookies in the category "Other. This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". This cookie is set by GDPR Cookie Consent plugin. EveryTwo is a low-cost and easy-to-use budget app that lets you fully customize your budget schedule whether its weekly, biweekly, every three weeks, monthly.

The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". The cookie is used to store the user consent for the cookies in the category "Analytics". These cookies ensure basic functionalities and security features of the website, anonymously. If you find you’ve got more money going out than what you’ve got coming in, you can use the planner to identify where you could be making savings.Necessary cookies are absolutely essential for the website to function properly. Mint, for just about everything YNAB, for hands-on zero-based budgeting Goodbudget, for hands-on envelope budgeting EveryDollar, for simple zero-based budgeting Empower Personal Wealth, for. Once you’ve included all your incomings and expenses, the planner can add them up and let you know exactly how much money you’ve got left over once all your expenses are covered. When doing so, the following questions are helpful: What income do I possess What am I spending my money for How much money is available to me Would I like. Using a budget planner can take the heavy lifting out of doing the maths. That means it might prompt you to include some you could otherwise have forgotten. The good thing about using a budget planner is it includes a detailed list of possible expenses. Some of these might seem obvious, such as your mortgage or rent payments as well as electricity and other utilities, but others might take a bit more thinking about, such as how much you spend on going out, or lunch at work for example. The next step is to include all your outgoings. But theres no reason you cant use more than one personal finance app at a time.

For example, you plan to spend only 600 for food this month in order to save money for a new phone. If you need to focus on budgeting your money down to the penny, YNAB is best. To make it easier, you can select on the frequency you get paid (e.g. Whats budget Its is simple plan to spend money. The most obvious stream of income is likely to be your salary or wages. any other questions, please reach out to us via the in-app chat in the Revolut app. Using a budget planner to work out your budgetĪ budget planner tool is essentially an online calculator that can be used to run the sums on your incomings and expenses.įirst up, the budget planner has fields to enter in your income. Empowered with plans, processes and data together, get real-time continuous planning across the whole organization from financial planning and analysis (FP&A). Take control of your money with smart budgeting and analytics tools. Not only is having a budget is a good way of finding out if you’re spending more or less money than you’ve got coming in, it’s also a good way of staying on track of your bills, as well as setting aside money to work towards savings goals.

Using a budget planner can take the heavy lifting out of sorting out your budget – you simply enter in the amount of money you’ve got coming in (such as your salary) and then put in the expenses you’ve got coming out.

0 kommentar(er)

0 kommentar(er)